Bitcoin

Posted by: Kevin Richardson on 06 August 2017

I'm selling all my material possessions, equities and bonds. So... I'll be back in 5 years once I have my Statement system up and running. Until then, thanks for all the good advice.

Kevin Richardson posted:winkyincanada posted:Kevin Richardson posted:Simon-in-Suffolk posted:Well I swapped in, rode it up and swapped back into bitcoin... I suspect it will dump... I did say I was giving this up... it’s too blooming addictive...

Excellent market timing....

Not so much for the chump that bought it at $420.

It's called volatility. Technical analysis points to $600 LTC this year.

"Technical analysis"? That's hilarious!

dave marshall posted:Kevin Richardson posted:winkyincanada posted:dave marshall posted:"if you lose the remaining stake, it is your loss, just as if you had lost your initial stake. You will perhaps feel better than if it was your original stake, but the money is lost to you just the same".

'Fraid we just seem to see things differently, as I don't see the remaining risk free balance as being "mine", since it's not as if it resulted from any "work" on my part.

I simply took a gamble which paid off. The "day at the races" philosophy I mentioned earlier works fine for me, so a loss of the remaining balance would only be "my" loss if I were to allow it to assume that role.

No, we agree that it is just a difference in how we "see" things. If I lose $100, then I have lost $100 regardless of whether I just found it, won it, or whether I worked for it. I'll feel differently perhaps, but there's no getting around that $100 is $100, regardless of what I "feel" that particular $100 is worth. (Unlike cryptos which are certainly only worth what the market "feels" they are worth.)

Good piece by Kevin O'Leary today who asserted that until counterparties accepted BTC without requiring insurance to cover price risk during prior to settlement (which is of course, conversion back to fiat or delivery of actual goods and services), they couldn't be considered a "currency". I'll add that until I'm paid, and happy to be paid in BTC, I won't consider it a currency.

Dave will never lose anything. He has acquired x VTC with a basis of $0.00. The number of VTC he owns will never decrease. He may lose some potential USD in the short term but VTC is likely to appreciate rapidly over the next two years. So the relevant number is not how many USD are at risk but how many VTC he owns.

He started with x $ and now has x $ + y VTC. Pretty smart move as he will be able to buy VTC again if it ever has a "price correction."

The probability of VTC going to $0.00 approaches 0%. The probability of VTC going to $17 in next year is better than 50%. The EV of holding VTC is > 1.

"Dave will never lose anything. He has acquired x VTC with a basis of $0.00. The number of VTC he owns will never decrease."

Nicely put, thank you.

I have no idea what either of you are talking about,

Now we have XRP making LTC look positively boring. BTC is so last week. I love this stuff! Who will be the next big winner? There's money for everyone! Come one, come all, step right up.

It is all a bit like going from table to table in a casino... I would not be surprised if the spotlight is back on Bitcoin in a week, and the alts start to drain again... I am not going to knock it as I have done rather well out of it, but boy is it manipulated... as long as you realise that, go for the higher market capitalisation Cryptos, and go for a mid to longer (for crypto that is a month or longer) term view, diversify across two or more Cryptos then you stand a good chance of getting a respectable return.

Kevin Richardson posted:It's called volatility.

I'll say!

winkyincanada posted:Now we have XRP making LTC look positively boring. BTC is so last week. I love this stuff! Who will be the next big winner? There's money for everyone! Come one, come all, step right up.

You are correct that there is money for all that take the risk. 300% increases in a week are rare but if you held LTC since last year you have a 8,000% gain. A year from today some of the coins will have another 2,000%+ gain. Short term it is really a gamble but the long term prospects are excellent.

Simon-in-Suffolk posted:It is all a bit like going from table to table in a casino... I would not be surprised if the spotlight is back on Bitcoin in a week, and the alts start to drain again... I am not going to knock it as I have done rather well out of it, but boy is it manipulated... as long as you realise that, go for the higher market capitalisation Cryptos, and go for a mid to longer (for crypto that is a month or longer) term view, diversify across two or more Cryptos then you stand a good chance of getting a respectable return.

What gives you the idea that BTC/LTC markets are manipulated?

Kevin Richardson posted:winkyincanada posted:Now we have XRP making LTC look positively boring. BTC is so last week. I love this stuff! Who will be the next big winner? There's money for everyone! Come one, come all, step right up.

.....the long term prospects are excellent.

Why?

And the USD, Euro, Yen, and GBP aren't manipulated? That's what QE, ZIRP, and NIRP are; manipulations. And ones that heavily favor the 1% at that.

Central banks are destroying the Western economies as we speak. 2008 redux is on the way, only this time on steroids. The bubble is getting bigger and bigger, and will pop.

I am pretty sure BTC will drop from the $17K level (actually it already has), but I still think it (or some crypto(s) long-term will survive and prosper, especially once it becomes easier to buy and hold.

But the Central Banksters will try mightily to not let anything stand in the way of their money monopoly. That monopoly is more powerful than any standing military there is, and they have time and again demonstrated a willingness to destroy anything & anyone that stands to disrupt their cabal if they think they can get away with it. (See, Hussein, Saddam; Gadaffi, Muammar).

I have heard private investors have already started work on a network that will operate outside of central control so cryptos can continue to be traded and exchanged. There must be something good about it, since it has clearly rattled and gotten the attention of the biggest a-holes on the planet.

DrMark posted:And the USD, Euro, Yen, and GBP aren't manipulated? That's what QE, ZIRP, and NIRP are; manipulations. And ones that heavily favor the 1% at that.

Central banks are destroying the Western economies as we speak. 2008 redux is on the way, only this time on steroids. The bubble is getting bigger and bigger, and will pop.

In the 2008 GFC asset prices collapsed and USD became significantly more valuable. Are you forecasting a repeat of that? What would happen to the price of cryptos in such a circumstance?

Yes, asset prices collapsed, but it was probably a case of the dollar being "the worst currency, except for all the others." Central banks and their bankrupt government sponsors (or is it the other way around?) fear deflation more than anything because it will crush them with carrying cost.

The Fed, ECB, and BoJ, in particular, have gone on a "money printing" spree, buying up assets and exploding their balance sheets.

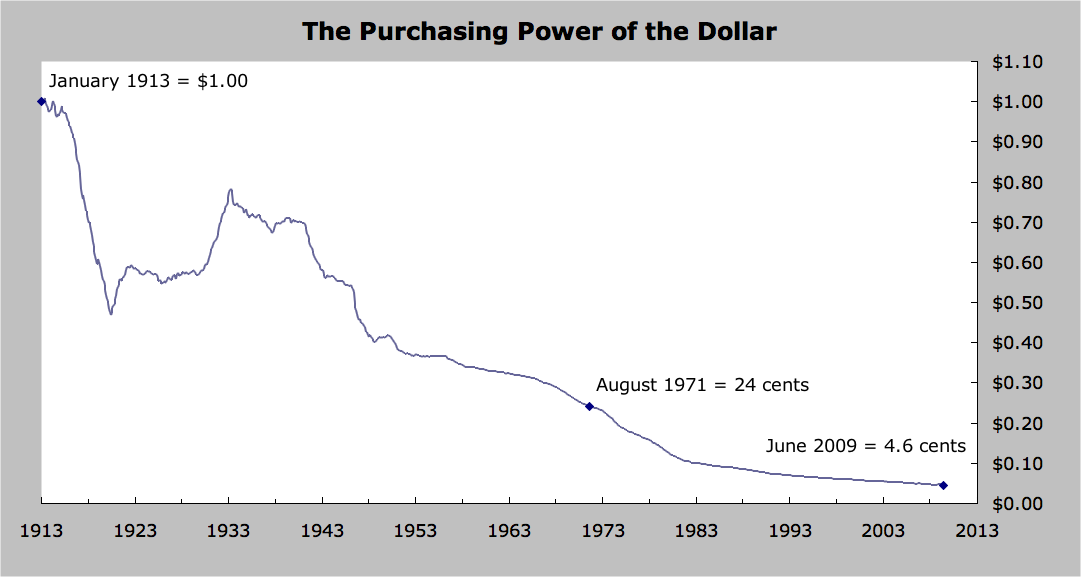

Yeah, the Fed has done a wonderful job maintaining the value of the dollar:

And the Fed's balance sheet since 2000

The problem is, they emptied their guns for the last crisis, so they are not going to be able to have the same policies work. That is why they are cranking up the "war on cash" because the zero interest rate boundary keeps them from stealing more from the populace at large to cover up their mistakes. Of course, they sell this as "only drug dealers and terrorists use cash", which will be the same argument they will use on cryptos.

I think things that are seen as stores of value will increase. Gold, probably cryptos. Real assets like quality businesses that produce things people need. Lots of people are going to lose jobs. As I have said here before, all that borrowed money (which is all they have done since 2008 GFC) is going to bite the borrowers and lenders both. The bond market is going to really be where the crisis gets rolling.

I am literally about to head out the door for some fairly serious vascular surgery (second in as many weeks) so all this may be moot to me in a few hours (hoping the surgeon is having a good day), but I will find a video that I saw recently that did an outstanding job of covering what is coming - just exactly when no one can pin down. I will try to post it here later. These central bankers are unethical a-holes, but they are exceptional at keeping the party going longer than anyone could imagine.

DrMark posted:And the USD, Euro, Yen, and GBP aren't manipulated? That's what QE, ZIRP, and NIRP are; manipulations. And ones that heavily favor the 1% at that.

Indeed - I guess it is the extent of the manipulation ... certainly in crypto/fiat exchanges there is a huge issue of pumping and dumping, and if you are not familiar with it you could end up out of pocket in a big way - to the extent that some exchanges send emails out to its members warning them and investing responsibly... I have not seen that in the same way way in traditional markets where there is more apparent regulation... but yes I agree these markets are controlled by centralised agencies such as national banks to varying extents.

Regarding Bitcoin - it has been consolidating its unitary value around $16.5k to $17k for a little time now (in crypto time) and drifting sideways - it has not dropped significantly with a 'correction' as many expected - I suspect post Christmas it will start rising again at its longer term rate.

DrMark posted:Yes, asset prices collapsed, but it was probably a case of the dollar being "the worst currency, except for all the others." Central banks and their bankrupt government sponsors (or is it the other way around?) fear deflation more than anything because it will crush them with carrying cost.

The Fed, ECB, and BoJ, in particular, have gone on a "money printing" spree, buying up assets and exploding their balance sheets.

Yeah, the Fed has done a wonderful job maintaining the value of the dollar:

And the Fed's balance sheet since 2000

The problem is, they emptied their guns for the last crisis, so they are not going to be able to have the same policies work. That is why they are cranking up the "war on cash" because the zero interest rate boundary keeps them from stealing more from the populace at large to cover up their mistakes. Of course, they sell this as "only drug dealers and terrorists use cash", which will be the same argument they will use on cryptos.

I think things that are seen as stores of value will increase. Gold, probably cryptos. Real assets like quality businesses that produce things people need. Lots of people are going to lose jobs. As I have said here before, all that borrowed money (which is all they have done since 2008 GFC) is going to bite the borrowers and lenders both. The bond market is going to really be where the crisis gets rolling.

I am literally about to head out the door for some fairly serious vascular surgery (second in as many weeks) so all this may be moot to me in a few hours (hoping the surgeon is having a good day), but I will find a video that I saw recently that did an outstanding job of covering what is coming - just exactly when no one can pin down. I will try to post it here later. These central bankers are unethical a-holes, but they are exceptional at keeping the party going longer than anyone could imagine.

If I kept my dollars stuffed in my mattress for a hundred years, I guess I'd be bothered. I don't really see what you're going on about. Has there been inflation? Sure. Steady at a bit less than 2% per year for decades. Annual loss of dollar value is higher at 3.2% per year for the hundred years of you graph. Meh. Holding T-bills would have you more-or-less square. Holding equities, you'd be well ahead. And that's kind of the point. Does the government have inflationary policy? of course. The alternative is pretty confusing, and arguably dysfunctional. I simply don't feel like the government has stolen anything from me by their enacting of monetary policy.

Do you think that value of the dollar is about to collapse (rampant Zimbabwean-style inflation), or that asset prices will collapse in USD terms (i.e. the dollar will become more valuable). Which apocalypse do you fear? If it's predictable, why aren't the FX traders making the bet (either way)?

To be fair, I'm not in the US, and hold no US currency whatsoever. Actually I hold no significant currency of any kind (I'm short some CAD). Currency isn't a store of value, nor a means of speculation for me. It's a just means of transaction. Get paid, then spend or invest in actual things (not digital fantasies). That the nominal price of currency changes over time is of no consequence to me (within reason). Example. If the price of my house doubled/tripled or if it halved (or worse), it still has exactly the same utility to me as a place to live. What an estate agent believes it would sell for really makes no significant difference.

winkyincanada posted:DrMark posted:Yes, asset prices collapsed, but it was probably a case of the dollar being "the worst currency, except for all the others." Central banks and their bankrupt government sponsors (or is it the other way around?) fear deflation more than anything because it will crush them with carrying cost.

The Fed, ECB, and BoJ, in particular, have gone on a "money printing" spree, buying up assets and exploding their balance sheets.

Yeah, the Fed has done a wonderful job maintaining the value of the dollar:

And the Fed's balance sheet since 2000

The problem is, they emptied their guns for the last crisis, so they are not going to be able to have the same policies work. That is why they are cranking up the "war on cash" because the zero interest rate boundary keeps them from stealing more from the populace at large to cover up their mistakes. Of course, they sell this as "only drug dealers and terrorists use cash", which will be the same argument they will use on cryptos.

I think things that are seen as stores of value will increase. Gold, probably cryptos. Real assets like quality businesses that produce things people need. Lots of people are going to lose jobs. As I have said here before, all that borrowed money (which is all they have done since 2008 GFC) is going to bite the borrowers and lenders both. The bond market is going to really be where the crisis gets rolling.

I am literally about to head out the door for some fairly serious vascular surgery (second in as many weeks) so all this may be moot to me in a few hours (hoping the surgeon is having a good day), but I will find a video that I saw recently that did an outstanding job of covering what is coming - just exactly when no one can pin down. I will try to post it here later. These central bankers are unethical a-holes, but they are exceptional at keeping the party going longer than anyone could imagine.

II simply don't feel like the government has stolen anything from me by their enacting of monetary policy.

Actually I hold no significant currency of any kind (I'm short some CAD). Currency isn't a store of value, nor a means of speculation for me. It's a just means of transaction. Get paid, then spend or invest in actual things (not digital fantasies). That the nominal price of currency changes over time is of no consequence to me (within reason).

In the USA capital gains are taxed without taking into consideration inflation over the time period a person owned the asset.

Kevin Richardson posted:winkyincanada posted:DrMark posted:Yes, asset prices collapsed, but it was probably a case of the dollar being "the worst currency, except for all the others." Central banks and their bankrupt government sponsors (or is it the other way around?) fear deflation more than anything because it will crush them with carrying cost.

The Fed, ECB, and BoJ, in particular, have gone on a "money printing" spree, buying up assets and exploding their balance sheets.

Yeah, the Fed has done a wonderful job maintaining the value of the dollar:

And the Fed's balance sheet since 2000

The problem is, they emptied their guns for the last crisis, so they are not going to be able to have the same policies work. That is why they are cranking up the "war on cash" because the zero interest rate boundary keeps them from stealing more from the populace at large to cover up their mistakes. Of course, they sell this as "only drug dealers and terrorists use cash", which will be the same argument they will use on cryptos.

I think things that are seen as stores of value will increase. Gold, probably cryptos. Real assets like quality businesses that produce things people need. Lots of people are going to lose jobs. As I have said here before, all that borrowed money (which is all they have done since 2008 GFC) is going to bite the borrowers and lenders both. The bond market is going to really be where the crisis gets rolling.

I am literally about to head out the door for some fairly serious vascular surgery (second in as many weeks) so all this may be moot to me in a few hours (hoping the surgeon is having a good day), but I will find a video that I saw recently that did an outstanding job of covering what is coming - just exactly when no one can pin down. I will try to post it here later. These central bankers are unethical a-holes, but they are exceptional at keeping the party going longer than anyone could imagine.

II simply don't feel like the government has stolen anything from me by their enacting of monetary policy.

Actually I hold no significant currency of any kind (I'm short some CAD). Currency isn't a store of value, nor a means of speculation for me. It's a just means of transaction. Get paid, then spend or invest in actual things (not digital fantasies). That the nominal price of currency changes over time is of no consequence to me (within reason).

In the USA capital gains are taxed without taking into consideration inflation over the time period a person owned the asset.

I did not know that. It is the same here in Canada.

How many of you own LTC right now?

Kevin Richardson posted:How many of you own LTC right now?

I bought mine at 420!

Kevin Richardson posted:How many of you own LTC right now?

Err no not any more, I have used it recently to trade ratios with BTC, but it is too unpredictable, and is dropping significantly currently. I may buy some if it goes below $200 per unit. I do use it to transfer crypto value between exchanges... so it has some good utility function, but not great holder of value.

Kevin Richardson posted:How many of you own LTC right now?

Yes, I'm roughly 45% BTC, 45% LTC, and 10% VTC.

Agreed, LTC is all over the place at the moment, but, as mentioned earlier in this thread, I've recovered my initial stake, and LTC is currently well above the price at the time of my purchase, so it's all good.

"I simply don't feel like the government has stolen anything from me by their enacting of monetary policy."

No one can tell you what to feel, but data would suggest otherwise.

The current situation is absolutely unsustainable. And Janet Yellen is a typical pure academician fool economist who has never held a real job. A Yale-educated moron. At yesterday's Fed meeting she was asked to grade her tenure at the Fed, This is a quite right out of Bloomberg (emphasis added):

"Look, at the moment, the U.S. economy is performing well," Yellen said. "The growth that we are seeing, it's not based on, for example, an unsustainable buildup of debt, as we had in the run-up to the financial crisis."

How she can say that with a straight face is a monument to stupidity, dishonesty, or both.

I agree currency is simply a means of transacting business. That is all it was ever meant to be. And I feel the same about my house as you do - it is a place where I live, not an investment. I bought it in April of 2013, and I could probably sell it for about 33% more than I paid for it...but then where would I live? I couldn't get a 2 bedroom apartment in this town for anywhere close to as low as my mortgage payment on my house.

Something IS going to trigger a huge crisis. And maybe as long as it doesn't seriously affect you, you don't really care. But a LOT of people are going to be destroyed, and I dare say none or almost none of those will come from the 1%, because the Central Banks and government will take care of them...that's what has happened since 2008. Artificially low interest rates have precipitated the biggest wealth transfer from the masses to the 1% in history. They gambled, lost, and took out the credit card and are sending the tax-payers the bill...taxpayers that haven't even been born yet. And that stupid woman sits in her ivory tower and spouts the BS above with a straight face. The entire faux-recovery (and make no mistake, it is almost all faux) is built on a mountain of debt.

But she is not alone; Draghi and Kuroda are working from the same playbook. Of course, they would; they're in the same cabal.

Again, it will be the bond markets. What will light the match and precisely when? Who knows. Could be US student loan or consumer debt, a lot of corporate debt, Italian banks, Canadian real-estate; no shortage of bubbles. But once they start popping, and all that debt that "isn't a problem" starts not getting paid back, watch out.

50% BTC, 35% ETH and 15% LTC.

DrMark posted:"I simply don't feel like the government has stolen anything from me by their enacting of monetary policy."

No one can tell you what to feel, but data would suggest otherwise.

The current situation is absolutely unsustainable. And Janet Yellen is a typical pure academician fool economist who has never held a real job. A Yale-educated moron. At yesterday's Fed meeting she was asked to grade her tenure at the Fed, This is a quite right out of Bloomberg (emphasis added):

"Look, at the moment, the U.S. economy is performing well," Yellen said. "The growth that we are seeing, it's not based on, for example, an unsustainable buildup of debt, as we had in the run-up to the financial crisis."

How she can say that with a straight face is a monument to stupidity, dishonesty, or both.

I agree currency is simply a means of transacting business. That is all it was ever meant to be. And I feel the same about my house as you do - it is a place where I live, not an investment. I bought it in April of 2013, and I could probably sell it for about 33% more than I paid for it...but then where would I live? I couldn't get a 2 bedroom apartment in this town for anywhere close to as low as my mortgage payment on my house.

Something IS going to trigger a huge crisis. And maybe as long as it doesn't seriously affect you, you don't really care. But a LOT of people are going to be destroyed, and I dare say none or almost none of those will come from the 1%, because the Central Banks and government will take care of them...that's what has happened since 2008. Artificially low interest rates have precipitated the biggest wealth transfer from the masses to the 1% in history. They gambled, lost, and took out the credit card and are sending the tax-payers the bill...taxpayers that haven't even been born yet. And that stupid woman sits in her ivory tower and spouts the BS above with a straight face. The entire faux-recovery (and make no mistake, it is almost all faux) is built on a mountain of debt.

But she is not alone; Draghi and Kuroda are working from the same playbook. Of course, they would; they're in the same cabal.

Again, it will be the bond markets. What will light the match and precisely when? Who knows. Could be US student loan or consumer debt, a lot of corporate debt, Italian banks, Canadian real-estate; no shortage of bubbles. But once they start popping, and all that debt that "isn't a problem" starts not getting paid back, watch out.

I guess I've been on the right side of it. My earnings, and the price of my investments (in nominal terms) has followed a steeper trajectory than inflation over time. The interest rates on my debt (held only as mortgages on real estate) have more-or-less been correlated with inflation, so in real terms, the rates have been around 1%-2% for the last 30 year (3%-4% in nominal terms less 2% inflation). The rate of appreciation of the price of the underlying asset has been equal or higher (even after CGT).

I don't deny that a huge transfer of wealth to the richest (relatively, in terms of % of total wealth held, at least) has occurred. Maybe I'm just (very slightly) on the right side of it. I've just been a wage earner my whole life, but don't really feel that the deck has been stacked against me.

We do hold Canadian real estate in the frothy Vancouver market. We are very lightly geared and it would take very significant, completely unprecedented drop in price (from current levels) to put our mortgage under water. The price is not otherwise a concern as we have no plans of selling. I guess if we ever downsize, it would be great for the market to be high, so we can pocket some cash. If we wanted to upsize a market crash would, of course, help us.

In terms of rent Vs buy, you need to consider the opportunity cost of investing the equity you have in your unit as well, as well as all costs of ownership, that renting would exempt you from - for many properties, they are significant. In theory, the market should correctly price renting with consideration of the prices of real estate. I've seen both circumstances where rents seem unreasonably high, versus circumstances where they seem cheap. Not really sure of the underlying mechanics. It is likely related to timing, as supply of real estate can be slow to respond to demand, particularly in some markets.

Yes, I have weighed the ownership vs rental conundrum and included the "carrying cost" of owning, which as you pointed out can be significant. There is also the mortgage interest deduction, which plays into the financials a little. But at present, it is a more than comfortable place to live for just me, although my desire to leave Charlotte at some point may win out; need the proper opportunity before "chucking it all".

However, I owned a small house while I was in pharmacy school, and ended up "upside down" in that post-2008, courtesy of the banking criminals. (Fortunately, I unloaded that headache a year ago.) And make no mistake, they are criminals no less odious than Al Capone. Being charitable, they are less criminal and more incompetent - hard to tease the 2 qualities apart. Read The Big Short if you haven't already. If you drive carelessly at high speed and ignore common sense driving rules, you may not have intended to kill anyone, but you are now still a criminal nonetheless when you do kill someone. (And in fact, you were before you ran the poor chap over). So many bank execs who should be in jail, but the US "Justice" Department just couldn't seem to find anything to press charges on.

The deck is stacked against everyone, except the 1%. That is why they keep doing what they're doing because the rigged game is in their favor, and cheating carries no consequences. Any benefit to the masses is almost "collateral benefit". But they have engaged in insanity to cover up their insanity, and the piper will be paid.

Here is a presentation (about 30 minutes) from an investment conference, that pretty well sums up where we are. He is a gold proponent, albeit not obnoxiously so (and not a "gold bug"), but more to the point he demonstrates the folly of where we are now. Mentions cryptos as well, and actually uses the Vancouver RE market in one example.

https://stansberrystreaming.co.../grant-williams.html

I don't think this link violates any forum rules.

We're in a dangerous place in the world economy, and this time is NOT going to be different. Pinning down the when is the tricky part...but if I could do that I would quit my job tomorrow.

DrMark posted:Yes, I have weighed the ownership vs rental conundrum and included the "carrying cost" of owning, which as you pointed out can be significant. There is also the mortgage interest deduction, which plays into the financials a little. But at present, it is a more than comfortable place to live for just me, although my desire to leave Charlotte at some point may win out; need the proper opportunity before "chucking it all".

However, I owned a small house while I was in pharmacy school, and ended up "upside down" in that post-2008, courtesy of the banking criminals. (Fortunately, I unloaded that headache a year ago.) And make no mistake, they are criminals no less odious than Al Capone. Being charitable, they are less criminal and more incompetent - hard to tease the 2 qualities apart. Read The Big Short if you haven't already. If you drive carelessly at high speed and ignore common sense driving rules, you may not have intended to kill anyone, but you are now still a criminal nonetheless when you do kill someone. (And in fact, you were before you ran the poor chap over). So many bank execs who should be in jail, but the US "Justice" Department just couldn't seem to find anything to press charges on.

The deck is stacked against everyone, except the 1%. That is why they keep doing what they're doing because the rigged game is in their favor, and cheating carries no consequences. Any benefit to the masses is almost "collateral benefit". But they have engaged in insanity to cover up their insanity, and the piper will be paid.

Here is a presentation (about 30 minutes) from an investment conference, that pretty well sums up where we are. He is a gold proponent, albeit not obnoxiously so (and not a "gold bug"), but more to the point he demonstrates the folly of where we are now. Mentions cryptos as well, and actually uses the Vancouver RE market in one example.

https://stansberrystreaming.co.../grant-williams.html

I don't think this link violates any forum rules.

We're in a dangerous place in the world economy, and this time is NOT going to be different. Pinning down the when is the tricky part...but if I could do that I would quit my job tomorrow.

I've read "The Big Short" (and seen the movie). I also recommend "Crash of the Titans". I have no love for bakers and financiers either. Banking has moved so far from the original simple principle of deferring consumption to provide for investment that it is unrecognisable. Trading for profit in a less-than-zero-sum high-speed market is just means of stealing the underlying assets, as are opaque derivatives and other complex financial engineering products. De-centralised transactions using block-chain may be able to short-cut and challenge the status quo, but I'm sceptical for a couple of reasons:

1) The current use of crypto seems to be almost exclusively a means of speculation. The degree to which the technology is being used to actually replace conventional transaction systems is trivial.

2) The underpinning "proof-of-work" authentication is egregiously inefficient by design. For these systems to become significant, they need to be much more efficient. A different mathematical authentication principal needs to be applied. Wasting huge amounts of energy and computing power just to run the computational systems is arguably more wasteful than paying the same costs to bankers. At the current trajectory, the block-chain craze will do major environmental damage to the planet if it becomes large enough.

https://arstechnica.com/tech-p...nsumption-explained/

https://en.bitcoin.it/wiki/Proof_of_Stake

Bitcoin miners, speculators and traders are in many ways no different to bankers. They seek wealth through activities that have little or no intrinsic value. They are out to steal from the people who are actually doing worthwhile things.

When I'm feeling my most sceptical, I fear that Kevin and Simon are right, but that the accelerating rush to steal value by mining crypto will continue unchecked and precipitate an environmental collapse. All the efforts in energy efficiency and renewable energy will all crumble ahead of the crypto steamroller.

I should say I have no crypto, and were I to do anything it would be with about $2K just as a speculation (as you said) and on specific coins...probably not Bitcoin. But i am too busy with too many plates in the air spinning right now to even consider it.

But as I said above, I think some will survive and thrive, and when it isn't such a PITA to set up and buy and "store" it, there will be a more even, liquid market.

The big difference between crypto "crooks" (and yes I agree they do exist) and banksters is the latter does their dirt in lockstep with the government, and currency laws and such pretty much force you into their system. (See the "war on cash" mentioned above as but one example). Plus the scale of what they did in 2008 is beyond anything ever seen, and again, nobody of any consequence went to jail. They are no better human beings than any despot you care to think of - just a different MO.

And they are doing it again, right now, right out in the open for all to see.